Top Guidelines Of Transaction Advisory Services

Table of ContentsA Biased View of Transaction Advisory ServicesExamine This Report about Transaction Advisory Services10 Easy Facts About Transaction Advisory Services ExplainedFascination About Transaction Advisory ServicesThe 20-Second Trick For Transaction Advisory Services

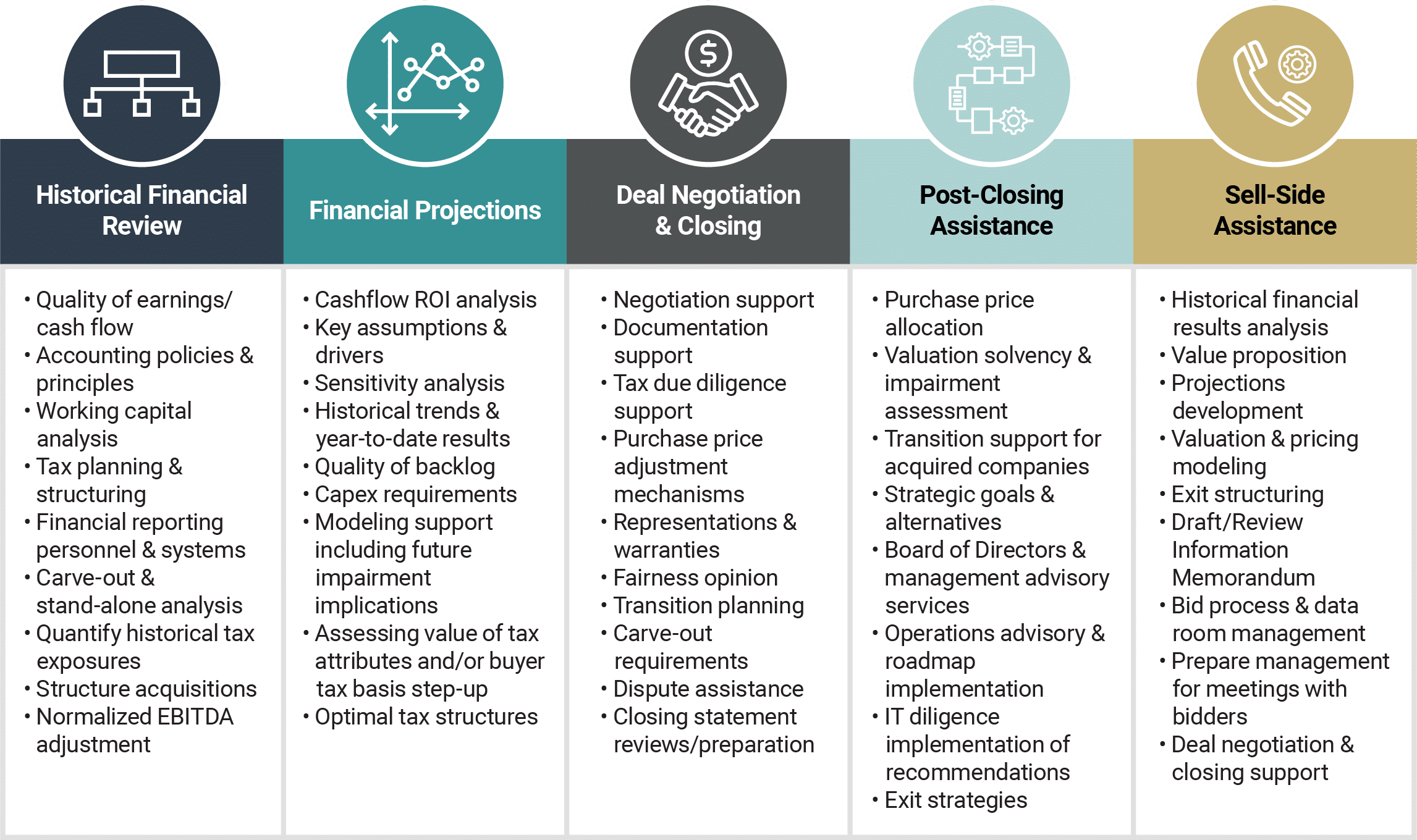

This action makes sure the service looks its ideal to possible customers. Getting the company's value right is vital for an effective sale.Deal consultants action in to assist by obtaining all the needed information arranged, answering concerns from customers, and arranging visits to the company's area. Deal consultants use their proficiency to aid organization proprietors deal with tough negotiations, fulfill buyer expectations, and structure bargains that match the owner's objectives.

Satisfying legal guidelines is important in any kind of company sale. They help organization owners in preparing for their following actions, whether it's retirement, starting a brand-new endeavor, or handling their newfound riches.

Deal consultants bring a wealth of experience and knowledge, making certain that every aspect of the sale is taken care of professionally. With calculated prep work, valuation, and settlement, TAS helps organization proprietors achieve the greatest feasible sale cost. By ensuring legal and regulative conformity and handling due diligence along with other bargain team members, purchase experts lessen potential dangers and liabilities.

Transaction Advisory Services Can Be Fun For Anyone

By comparison, Large 4 TS teams: Work on (e.g., when a potential customer is performing due persistance, or when a deal is closing and the buyer requires to incorporate the company and re-value the vendor's Annual report). Are with charges that are not connected to the bargain closing successfully. Gain charges per engagement someplace in the, which is less than what investment banks gain also on "little deals" (however the collection chance is also a lot higher).

, however they'll concentrate a lot more on accountancy and assessment and much less on subjects like LBO modeling., and "accounting professional just" subjects like trial balances and just how to walk through occasions making use of debits and credit ratings rather than economic declaration modifications.

The Best Strategy To Use For Transaction Advisory Services

that show how both metrics have transformed based upon items, channels, and customers. to evaluate the precision of monitoring's previous forecasts., consisting of aging, supply by item, typical degrees, and stipulations. to figure out whether they're totally imaginary or rather believable. Professionals in the TS/ FDD teams might additionally talk to administration about everything above, and they'll write a detailed record with their searchings for at the end of the process.

The power structure in Transaction Services differs a little bit from the ones in investment banking and exclusive equity jobs, and the basic form appears like this: The entry-level role, where you do a great deal of information and economic evaluation (2 years for a promo from below). The following level up; comparable work, but you get the even more interesting little bits (3 years for a promotion).

Specifically, it's tough to get advertised beyond the Manager degree since few people leave the work at that phase, and you need to start revealing proof of your ability to create profits to breakthrough. Let's begin with the hours and lifestyle since those are less complicated to describe:. There are periodic late nights and weekend break work, however absolutely nothing like the frenzied nature of investment banking.

There are cost-of-living adjustments, so expect reduced compensation if you're in a less expensive area outside major monetary (Transaction Advisory Services). For all placements other than Partner, the base salary makes up the mass of the total settlement; the year-end benefit may be a max of 30% of your base pay. Often, the very best way to enhance your earnings is to change to a various company and discuss for a greater salary and bonus

8 Easy Facts About Transaction Advisory Services Explained

At this phase, you need to just stay and make a run for a Partner-level duty. If you desire to leave, possibly relocate to a client and execute their evaluations and due persistance in-house.

The primary issue is that due to the fact that: You typically require to join one more Big 4 team, such as audit, and job there for a couple of years and after that relocate into TS, job there for a couple of years and click over here now then move into IB. And there's still no warranty of winning this IB role due to the fact that it relies on your region, clients, and the working with market at the time.

Longer-term, there is likewise some threat of and because assessing a business's historic financial details is not exactly rocket scientific research. Yes, humans will certainly constantly need to be entailed, but with advanced modern technology, lower head counts can possibly support customer involvements. That said, the Transaction Providers group defeats audit in terms of pay, work, and leave opportunities.

If you liked this post, you could be curious about reading.

The Ultimate Guide To Transaction Advisory Services

Establish innovative monetary you can try here structures that help in determining the real market price of a company. Provide consultatory work in connection to organization assessment to aid in negotiating and pricing frameworks. Describe the most appropriate kind of the bargain and the sort of consideration to use (cash, stock, earn out, and others).

Create action prepare for danger and direct exposure that have been identified. Do combination planning to establish the process, system, and organizational adjustments that might be required after the bargain. Make mathematical quotes of integration costs and benefits to evaluate the financial reasoning of integration. Set standards for incorporating departments, innovations, and company processes.

Identify potential reductions by minimizing DPO, DIO, and DSO. Analyze the potential client base, market verticals, and sales cycle. Take into consideration the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence provides important understandings right into the performance of the company to be gotten worrying threat assessment and value production. Recognize temporary official statement alterations to funds, financial institutions, and systems.